-

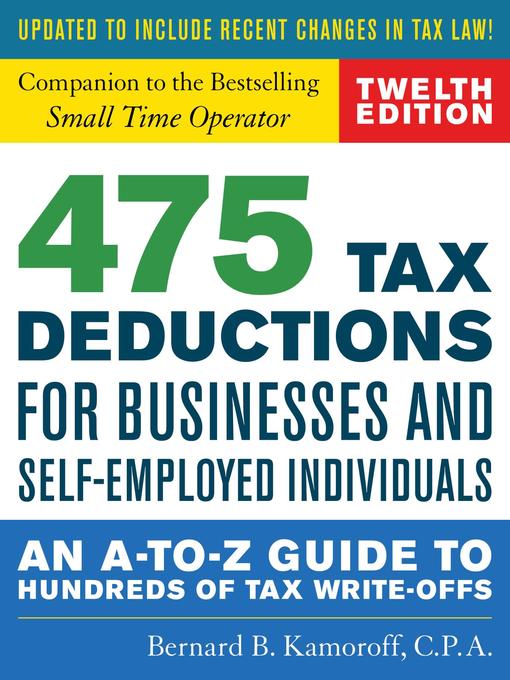

Description

-

Details

Kindle Book

- Release date: February 1, 2018

OverDrive Read

- ISBN: 9781493032198

- File size: 4403 KB

- Release date: February 1, 2018

EPUB ebook

- ISBN: 9781493032198

- File size: 4403 KB

- Release date: February 1, 2018

Formats

Kindle Book

OverDrive Read

EPUB ebook

subjects

Languages

English